Picture this – your beloved California Spangled, who is usually active and playful, suddenly seems unwell. You take them to the vet, and the diagnosis confirms your worst fears. The treatment expenses are high, and you find yourself worrying about the financial burden of caring for your furry family member. That’s where healthcare plans come in. They not only provide peace of mind but also ensure that your California Spangled receives the best medical care possible. In this article, we explore the various healthcare plans available for your feline friend, their pros and cons and help you choose the best option that suits your needs and that of your feline friend.

Why Your California Spangled Needs Healthcare?

Cats, including California Spangled cats, require healthcare primarily to maintain good health and longevity. Providing your cat with healthcare via veterinary check-ups, proper nutrition, and other preventative measures can help identify health issues before they become serious. Regular check-ups are imperative in identifying illnesses and diseases at the earliest stages, which can be easily treated, in addition to providing required vaccinations to ensure that your furry friend is healthy.

In addition to preventative care, emergency care can be costly and being prepared to handle it can save your cat’s life. Unexpected accidents or illnesses can happen at any time, and it is important to have a healthcare plan that will cover emergency medical care. It is important to be prepared for chronic illnesses that your cat may develop over time, such as arthritis or diabetes, which would require a long-term healthcare plan to manage these conditions.

Taking an active role in managing your California Spangled cat’s healthcare requires more than just providing a balanced diet and adequate exercise. Ensuring that they receive proper healthcare can improve their quality of life and keep them feeling their best. Regular veterinary check-ups are essential for ensuring that your cat’s physical health is optimal. Proactive healthcare measures such as a proper diet and providing essential vitamins and minerals and dental care can prevent health problems from occurring and keep your cat healthy.

In short, it is imperative that you provide your beloved California Spangled cat with the best healthcare possible, no matter what their age or level of fitness. Regular check-ups, vaccinations, proper diet, exercise, and other preventative healthcare measures can help keep your pet happy and healthy for years to come. Take a look at our cat check-up guide for more tips on how to keep your California Spangled healthy.

Preventative Care

Making sure that your California Spangled is as healthy as possible is one of the top priorities for any pet owner. One of the best ways to ensure that your cat is in the best health possible is through preventative care. Preventative care involves taking steps to prevent health problems in your cat before they occur. This can include regular check-ups and vaccinations, as well as things you can do at home to keep your cat healthy and happy.

Vaccinations: One of the most important parts of preventative care for your California Spangled is making sure that they are up to date on all of their vaccinations. This will help to protect your cat from a range of diseases including feline herpes, feline leukemia, and rabies. You should talk to your veterinarian about the recommended vaccination schedule for your cat based on their age and lifestyle.

Nutrition: Providing your California Spangled with a healthy and balanced diet is also an important part of preventative care. You should make sure that your cat is eating a diet that is high in protein and includes all the necessary vitamins and minerals. You may also want to consider adding supplements to your cat’s diet to help support their overall health.

Regular Check-Ups: It’s also important to take your California Spangled to the veterinarian for regular check-ups, even if they are not showing any signs of illness. This will allow your vet to catch any potential health problems early and give your cat the best chance for a full recovery.

Dental Care: Dental health is often overlooked when it comes to cat care, but it is an important part of preventative care. Regular tooth brushing and dental cleanings can help to prevent dental problems such as gum disease, which can lead to other health problems if left untreated.

By taking steps to prevent health problems before they occur, you can help ensure that your California Spangled stays healthy and happy. To learn more about preventative care and other ways to keep your cat healthy, check out our article on California Spangled cat health tips.

Emergency Care

Emergency Care

No one wants to think about their cat facing an emergency or an accident, but it’s important to be prepared in case something does happen to your California Spangled. When considering healthcare plans, it’s important to think about emergency care coverage.

Accidents can happen at any time and emergency vet visits can be expensive. Without coverage, owners may find themselves in a difficult position when their cat requires urgent treatment. This is where a good healthcare plan can make all the difference in ensuring the best possible outcome for your furry friend.

Many plans offer coverage for emergency care, but it’s important to carefully read the fine print to understand what is and isn’t covered. Some plans may only cover a certain amount of the emergency costs, leaving the owner to cover the rest. Others may require the owner to first pay a deductible before any emergency coverage kicks in.

When it comes to emergency care, it’s best to opt for a plan that has comprehensive coverage. Look for a plan that covers emergency room visits, hospitalization, surgery, and diagnostic testing. This will give you peace of mind that your cat will be taken care of in the case of an emergency, without worrying about costs.

It’s also important to remember that prevention is key in avoiding emergencies. Regular check-ups with the vet can help catch potential medical issues before they become emergencies. This is where preventative care coverage comes in, which can also be included in some healthcare plans.

Conclusion: It’s important to consider emergency care coverage when choosing a healthcare plan for your California Spangled. While no one wants to think about emergencies, it’s important to be prepared. Look for a plan that offers comprehensive coverage, and remember to also prioritize preventative care to avoid emergencies whenever possible.

Chronic Illness

Chronic illness refers to health problems that persist over a longer period and require ongoing treatment or management. California Spangled cats, like any other breed, are susceptible to certain chronic illnesses such as diabetes, heart disease, kidney disease, and cancer. Managing these conditions can be quite expensive, which is why having a good healthcare plan for your cat is crucial.

A traditional/standard healthcare plan may be a suitable option for California Spangled cats with chronic conditions. Under this plan, the cat owner pays a premium each month, and the insurance company covers the cost of medical treatment, including medication, diagnostic tests, and visits to the veterinarian. This can be beneficial in the long run as it provides financial security for managing ongoing health issues.

Another option is a holistic or alternative healthcare plan, which focuses on a more natural and less invasive approach to managing chronic health issues. This may include incorporating herbal remedies, acupuncture, and other non-conventional treatments. The primary advantage of this plan is that it avoids using drugs or surgery to treat chronic issues and hence has fewer side effects. However, it is important to note that not all insurance providers offer comprehensive coverage for alternative treatments.

It is important to consult with your veterinarian when selecting a healthcare plan for your California Spangled cat with a chronic illness. Your vet can help guide you through the pros and cons of different plans and recommend a plan that best suits your cat’s specific medical needs and lifestyle.

In addition to healthcare plans, maintaining a proper diet, ensuring your California Spangled cat receives regular check-ups, and keeping up with preventative measures such as vaccines and spaying/neutering are also crucial for managing chronic health issues. Nutritional supplements such as vitamins and minerals can also be beneficial in preventing or managing chronic illnesses.

Having a healthcare plan for your California Spangled cat with a chronic illness is crucial for financial security and effective management of their health. Traditional/standard healthcare plans or alternative/holistic healthcare plans may be suitable options, but it is important to consult with your veterinarian and weigh the pros and cons carefully.

Types of Healthcare Plans

When it comes to finding a healthcare plan for your beloved California Spangled Cat, there are several options to consider. The type of plan you choose may depend on your cat’s specific needs, your budget, and your personal preferences. Here are three common types of healthcare plans for cats:

1. Traditional/Standard Plans:

Traditional health plans for cats typically provide comprehensive coverage for preventative care, emergency care, and chronic illnesses. These plans usually have a monthly premium and a deductible that must be paid before coverage kicks in. The deductible and premium may vary depending on the plan and your cat’s age or health status. Traditional plans often cover routine check-ups, vaccinations, and common illnesses, such as ear infections and urinary tract infections.

2. High Deductible Health Plans:

Similar to high deductible health plans for humans, these plans require you to pay a higher deductible before coverage begins. However, the monthly premium for these plans is usually lower. High deductible health plans may be a good option if you are looking to save money on your monthly premium but still want coverage in case of emergency or unexpected illness. These plans may be best suited for healthy cats that don’t require frequent vet visits.

3. Wellness Plans:

Wellness plans are designed to cover routine preventative care, such as annual exams, vaccinations, and dental cleanings. These plans usually require a monthly payment and don’t have a deductible. Wellness plans may be a good choice if you want to ensure that your cat receives regular preventative care without worrying about the cost.

Ultimately, the healthcare plan you choose for your California Spangled Cat will depend on several factors. It’s important to consider your cat’s age, health status, and any pre-existing conditions when selecting a plan. You should also think about your budget and personal preferences. No matter what plan you choose, be sure to take your cat for regular check-ups and seek veterinary care if you notice any signs of illness or distress.

If you want to learn more about keeping your California Spangled Cat healthy and happy, you may be interested in reading our articles on cat diet and nutrition, cat dental health, and when to take your cat to the vet.

Traditional/Standard Plans

Traditional/Standard Plans are the most common type of healthcare plans for California Spangled cats. These plans are often offered by employers or purchased directly from insurance providers. They allow your cat to see any veterinarian within a certain network and cover a range of services such as preventative care, surgery, and emergency care. Certain procedures such as spaying and neutering may also be covered under these plans, depending on your policy.

Pros: Traditional/Standard Plans offer a range of benefits for your California Spangled cat. Firstly, they provide a large network of veterinarians, giving your cat access to a wide range of healthcare providers. Secondly, they often offer a comprehensive range of covered services, which can provide peace of mind if your cat experiences a sudden illness or injury. Additionally, some plans offer the option of choosing a higher premium plan, which can offer more coverage and better overall benefits.

Cons: While Traditional/Standard Plans offer many benefits, they can also come with some drawbacks. One of the main disadvantages of these plans is that they can be quite costly, particularly if you opt for a more comprehensive plan. Additionally, depending on your policy, you may be required to pay a deductible before the plan covers any costs. Some plans may also require you to pay a co-pay for each visit, which can add up over time. Lastly, certain procedures may not be covered under your policy, so it’s important to carefully review your plan to ensure that it covers the services you need.

Traditional/Standard Plans can be a good option for many California Spangled cat owners. They offer a wide range of benefits and give you the peace of mind of knowing that your cat is covered in case of an emergency. However, it’s important to carefully review your policy and consider your budget before choosing a plan. If you’re looking for information on spaying and neutering, check out our article on Cali Spangled spay and neuter. If you’re concerned about allergies, read our article on California Spangled cat allergies for more information.

High Deductible Health Plans

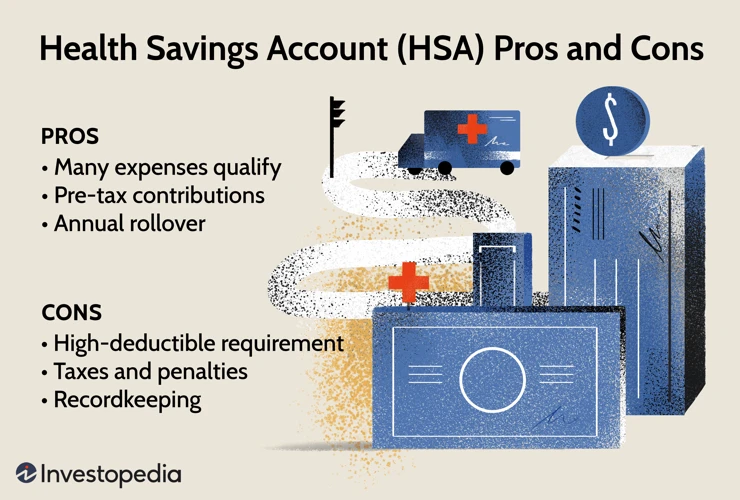

High deductible health plans (HDHPs) are becoming increasingly popular among pet owners in California, mainly because of their low premiums and tax benefits. In an HDHP, the deductibles are much higher than traditional plans, and the out-of-pocket costs are also higher. In return, the premiums are lower, making HDHPs an attractive option for those who do not visit the vet often.

Pros:

One of the biggest advantages of HDHPs is their low premiums. They are ideal for pet owners who are planning to save money on insurance. HDHPs are eligible for Health Savings Accounts (HSAs), which offer tax benefits and allow pet owners to save for future medical expenses.

Another advantage of HDHPs is that they usually cover preventative care such as vaccinations and wellness exams, which can help detect health problems early on and lead to better long-term outcomes for your California Spangled cat.

Cons:

The biggest disadvantage of HDHPs is their high deductible, which can be a significant financial burden if your California Spangled cat requires extensive medical treatment. Additionally, HDHPs may not cover certain services that are typically covered by traditional plans, such as prescription medications, routine blood work, or even emergency care.

Another potential downside of HDHPs is that they may discourage pet owners from seeking necessary medical care for their California Spangled cats, as they may not want to pay the high out-of-pocket costs associated with the deductible.

HDHPs can be an attractive option for pet owners who are looking to save money on insurance. However, they come with high out-of-pocket costs and may not cover all the necessary medical services that traditional plans do, which could potentially harm the health of your California Spangled cat.

Wellness Plans

If you’re looking for a healthcare plan that focuses on preventive care for your California Spangled, you might want to consider a wellness plan. These plans are designed to promote proactive health practices and screenings to keep your cat healthy and prevent major health issues from arising.

Pros: Wellness plans typically cover preventive care, such as regular check-ups and vaccinations, at no additional cost to you. This can save you money in the long run by catching any potential health issues before they become major problems. Additionally, wellness plans sometimes include coverage for dental cleanings, which can also help prevent more serious dental issues from occurring.

Another major benefit of wellness plans is that they encourage you to stay on top of your California Spangled’s health. Regular check-ups and screenings can ensure that your cat stays healthy and receives any necessary treatment right away. This can give you peace of mind and help you avoid the stress and expense of dealing with a major health issue down the line.

Cons: While wellness plans are great for preventive care, they may not cover the costs of major illnesses or accidents. If your cat does end up needing more serious medical attention, you may find that your wellness plan doesn’t provide the coverage you need. It’s important to read the fine print and understand exactly what your plan covers before signing up.

Another potential downside of wellness plans is that they may require you to commit to a specific veterinary practice for all of your cat’s care. This can limit your options and make it difficult to switch to a different provider if you’re unhappy with the service you’re receiving.

Wellness plans can be a great option for keeping your California Spangled healthy and catching any potential health issues early on. However, it’s important to carefully consider the pros and cons before signing up for any healthcare plan to ensure you’re getting the coverage you need at a price you can afford.

Pros and Cons of Traditional/Standard Plans

When it comes to traditional or standard healthcare plans for your California Spangled, there are both pros and cons to consider. These plans typically have more comprehensive coverage than other types of plans, but they also come with higher monthly premiums.

Pros: One of the biggest advantages of traditional plans is their broad coverage options. They often cover preventative care, emergency care, prescription medication, and specialist visits. This can give you greater peace of mind knowing that your cat will have access to the care they need when they need it.

Another pro of traditional plans is that they often have lower deductibles than high deductible plans, meaning you’ll have to pay less out of pocket before your insurance kicks in. This can make it easier to manage unexpected healthcare costs without breaking the bank.

Cons: The biggest downside to traditional plans is that they can have higher monthly premiums, which can be difficult to afford for some pet owners. They can also have higher out-of-pocket costs for things like copays and coinsurance. This can make it harder to manage your cat’s healthcare costs over time, especially if they have a chronic condition that requires ongoing treatment.

Another con is that traditional plans may not cover alternative or holistic treatments, which some pet owners prefer for their cats. If you’re interested in alternative therapies like acupuncture or herbal remedies, you may need to look for a specialized plan or pay out of pocket for those treatments.

Traditional plans can offer comprehensive coverage for your California Spangled, but they come with higher costs that may not be feasible for every pet owner. Be sure to evaluate your budget and your cat’s healthcare needs carefully before choosing a plan.

Pros

When it comes to traditional/standard healthcare plans for your California Spangled, there are several benefits that cannot be ignored.

Comprehensive Coverage: Traditional plans provide comprehensive coverage for a wide range of medical services including routine checkups, emergency care, surgery, and prescription drugs. This means that your California Spangled can access care whenever they need it without worrying about running out of coverage.

Large Network of Providers: The majority of traditional plans have large networks of service providers. These include hospitals, clinics, and doctors, making it easy for your California Spangled to find the right provider for their healthcare needs.

Fixed Premiums: Traditional plans typically have fixed premiums, meaning you pay the same amount each month regardless of how many times your California Spangled visits the vet. This type of plan makes it easier to budget for healthcare expenses as you don’t have to worry about unexpected bills.

No Restrictions on Pre-existing Conditions: Traditional plans do not deny coverage for pre-existing medical conditions. So if your California Spangled has a pre-existing condition, they will still be covered under a traditional plan.

Despite these benefits, there are also some downsides to traditional plans that should be taken into consideration.

Higher Monthly Premiums: Traditional plans have higher monthly premiums compared to other types of plans. This can be a financial burden, especially if you’re on a tight budget.

Co-payments and Deductibles: Traditional plans usually come with co-payments and deductibles. This means that you’ll have to pay a certain amount out of pocket before your insurance starts covering the rest of the expenses. This can be a disadvantage, especially if you have a chronic condition that requires frequent medical attention.

Limited Flexibility: Traditional plans are not as flexible as other types of plans. They may have limited coverage for alternative treatments, experimental therapy, or out-of-network providers. If you’re looking for more flexibility for your California Spangled, then a traditional plan may not be the best option.

Traditional plans can be a great option for those looking for comprehensive coverage and a large network of providers. However, the higher monthly premiums and limited flexibility should also be taken into consideration before making a decision.

Cons

While there are several benefits to high deductible health plans (HDHPs), there are also some drawbacks to consider before choosing this type of healthcare plan for your California Spangled.

Higher Out-of-Pocket Costs

One of the biggest drawbacks of HDHPs is the higher out-of-pocket costs associated with them. While the monthly premiums for HDHPs are typically lower than traditional plans, the annual deductibles are much higher. This means that you will have to pay a larger portion of your healthcare costs before your insurance coverage kicks in. This can be a problem for individuals with chronic conditions or those who require frequent medical care, as they may quickly reach their deductible and have to pay a significant amount out-of-pocket.

Limited Provider Options

Another potential drawback of HDHPs is the limited provider options. Many HDHPs have a smaller network of healthcare providers to choose from, which can make it difficult to find a provider that meets your needs. If you have a preferred physician or specialist, it’s important to check whether they are in your plan’s network before choosing a HDHP.

Delayed or Skipped Care

Because of the higher out-of-pocket costs associated with HDHPs, some individuals may delay or skip necessary medical care to avoid incurring additional costs. This can be particularly dangerous for those with chronic conditions or preventative care needs. Delayed or skipped care can lead to more serious health problems down the line, which can end up being even more expensive to treat.

Not Eligible for Health Savings Account

In order to participate in a health savings account (HSA), you must be enrolled in a HDHP. However, not all HDHPs are eligible for HSAs. This can be a drawback if you were planning on using an HSA to save on healthcare costs.

While HDHPs can offer lower monthly premiums, it’s important to carefully consider the potential drawbacks before choosing this type of healthcare plan for your California Spangled.

Pros and Cons of High Deductible Health Plans

High Deductible Health Plans (HDHPs) can be an attractive option for your California Spangled if you are looking for a healthcare plan with lower monthly premiums. These plans usually have a higher deductible, which is the amount you have to pay out of pocket before insurance kicks in. HDHPs are becoming increasingly popular, but they have both pros and cons to consider before signing up.

Pros:

1. Lower premiums: One of the most significant advantages of HDHPs is that they generally have lower monthly premiums than traditional healthcare plans. This means that you’ll have extra cash in your pocket to cover other expenses.

2. Health Savings Account: HDHPs are often paired with a Health Savings Account (HSA), which is a tax-advantaged account used to pay for eligible medical expenses. You can contribute pre-tax money into the account, and the funds can be used to cover your deductible and other medical costs.

3. Encourages cost-conscious decisions: When you have a high deductible, you may be more conscious of the cost of medical services and choose to only receive care when necessary, potentially leading to lower overall healthcare costs.

Cons:

1. High deductible: The high deductible on an HDHP means that you’ll have to pay more out of pocket before your insurance coverage kicks in. This could be an issue if you need frequent medical care or have a chronic illness.

2. Risk of financial strain: If you have a large medical expense that exceeds your deductible, it can be a financial strain. Make sure you have enough savings to cover the deductible or consider a different plan that has a lower deductible.

3. Limited benefits: HDHPs often have limited benefits compared to traditional healthcare plans. For example, certain services may not be covered until you reach your deductible.

HDHPs can be a great choice for some California Spangled owners who want to save money on their monthly premiums and are willing to take on higher out-of-pocket costs. However, it’s essential to carefully consider the pros and cons before enrolling in such a plan to make sure it’s the right fit for you and your pet’s healthcare needs.

Pros

When it comes to the pros of a traditional/standard healthcare plan for your California Spangled, there are several things to consider. Firstly, these plans often have a wider network of providers, giving you and your cat more options for medical care. This means that you may not have to travel as far to find a vet that accepts your insurance, which is especially important if you live in a rural area.

Another advantage of traditional plans is that they typically provide coverage for a broader range of services, including prescription medications, specialist visits, and hospital stays. This can be especially beneficial in the case of a serious illness or injury, where you may need to seek out more specialized care.

Traditional plans also tend to have lower out-of-pocket costs, which can be helpful if you’re on a budget. You may be required to pay a co-pay for office visits or certain medical services, but these costs are often minimal compared to the cost of a high deductible plan.

On the other hand, traditional plans do come with some drawbacks. One of the biggest downsides is that they tend to be more expensive than alternative options, both in terms of monthly premiums and out-of-pocket costs. Additionally, these plans may have higher deductibles, which means that you’ll need to pay a certain amount of money out of pocket before your insurance kicks in. This can be a significant financial burden, especially if you’re already struggling to make ends meet.

Traditional plans may also include limits on the amount of coverage you can receive each year. This means that if your California Spangled requires a lot of medical care within a short period of time, you may find yourself reaching the maximum amount of coverage and having to foot the bill for additional expenses. It’s important to carefully review the terms and conditions of any healthcare plan before signing up, to make sure you understand what’s included and how much it will cost.

Cons

When it comes to the disadvantages of opting for a high deductible health plan for your California Spangled, there are a few things you should be aware of. One major drawback is the high out-of-pocket costs that come with the deductible. Since the deductible is much higher than traditional plans, you will likely have to pay more before your coverage kicks in. This could put a financial strain on your budget, especially if your cat requires frequent medical attention.

Additionally, high deductible plans may not cover all of the services that your cat needs. While they do cover preventative care, they may not cover more complicated treatments or surgical procedures. As a result, you may end up having to pay for these expenses out of your own pocket. This could be particularly problematic in the case of a chronic illness that requires ongoing treatment.

Another potential disadvantage of high deductible health plans is that they may not offer as much flexibility in terms of choice of provider. Some of these plans may limit your choices of hospitals and doctors that you can see. This could make it difficult to get the care you need if your preferred provider is not included in your plan.

Lastly, high deductible health plans may not be the best option for those who have a lot of medical issues or who have high healthcare expenses. Since these plans are designed to have lower monthly premiums, they may not be the best choice for someone who needs a lot of medical attention throughout the year. The high out-of-pocket costs for treatment may end up being more than what you would pay for a traditional plan with a higher monthly premium.

While there are certainly drawbacks to consider when it comes to high deductible health plans, it’s important to remember that they can also be a good option for those who want to save money on monthly premiums. Ultimately, it’s up to you to weigh the pros and cons and decide which type of healthcare plan is best suited for your California Spangled and your own personal situation.

Pros and Cons of Wellness Plans

The Pros and Cons of Wellness Plans for Your California Spangled

Wellness plans are a type of pet healthcare plan that focuses on preventative care. These plans encourage pet owners to bring in their furry friends for regular check-ups and routine care, such as vaccinations, dental cleanings, and preventative treatments for parasites. Wellness plans are meant to catch health issues before they become more serious, which can help save money in the long run. However, as with any type of healthcare plan, there are pros and cons to consider when deciding if a wellness plan is right for your California Spangled.

Pros of Wellness Plans

One of the most significant benefits of wellness plans is the preventative care that they provide. By regularly bringing your California Spangled to the vet for check-ups, vaccinations, and other preventative treatments, you may be able to catch any health issues before they become more severe and more expensive to treat. Additionally, many wellness plans offer additional perks such as discounted grooming services or free consultations with a veterinarian if your pet is experiencing an issue. This can help to save you money on these types of services in the long run.

Another significant pro of wellness plans is that they can help to spread out the cost of routine pet care over the course of a year. Many wellness plans offer monthly payment options that can be easier to budget for than paying for all of your pet’s preventative care services at once. This can be a significant relief to pet owners who are worried about the financial impact of paying for preventative care.

Cons of Wellness Plans

While wellness plans can help to reduce costs associated with preventative care, they may not be the best fit for every pet owner. For example, if your California Spangled has a chronic health issue that requires frequent vet visits or medication, a wellness plan may not offer the level of coverage that you need. Additionally, some wellness plans have limitations on coverage, which can limit the types of preventative treatments that your pet can receive. It’s important to carefully review the specifics of any wellness plan that you are considering to ensure that it meets your needs and those of your furry friend.

Another potential con of wellness plans is that they may not provide coverage for emergencies or unexpected health issues outside of regular preventative care. If your California Spangled experiences a major health issue that requires emergency treatment, you may not be covered under a wellness plan. This means that you may still need to budget for unexpected veterinary costs even if you have a wellness plan in place.

Conclusion

Wellness plans can be a great option for pet owners who want to ensure that their California Spangled is receiving the best possible preventative care. However, as with any type of healthcare plan, it’s essential to carefully consider the pros and cons before enrolling. By weighing the benefits and limitations of a wellness plan, you can make an informed decision about the best type of healthcare plan for your furry friend.

Pros

Traditional/Standard healthcare plans for your California Spangled offer a range of benefits for pet owners. Some of the pros of this type of healthcare plan include comprehensive coverage that includes check-ups, preventative care, emergency visits, and chronic illness treatment. Additionally, traditional plans offer predictable out-of-pocket expenses with a set copay and annual deductible.

When it comes to covering costs, traditional plans typically have a broader network of providers and often offer coverage for more services. This means pet owners have more flexibility in choosing the right veterinarian or specialist for their California Spangled without worrying about limited coverage. Conversely, traditional plans may also cover alternative medicine treatments and experimental therapies that are emerging for chronic diseases and conditions in animals.

Another advantage of traditional healthcare plans for your cat is pre-existing conditions covered after a waiting period. This means pet owners do not have to worry about exclusions for pre-existing conditions as long as the waiting period is satisfied. Finally, traditional pet plans offer peace of mind for pet owners knowing that their California Spangled is covered in case of accidents, illness, or emergencies.

Traditional/standard healthcare plans offer a range of pros for pet owners who want comprehensive coverage and predictable expenses for their furry friend. While there may be higher monthly premiums than other plans, the peace of mind and flexibility in providers and coverage offered by traditional plans may make it the ideal option for your California Spangled.

Cons

While high deductible health plans (HDHPs) have their advantages, they also come with some significant disadvantages. One of the most significant drawbacks of HDHPs is the high out-of-pocket costs that come with a high deductible. This can be a major financial burden for pet owners who are on a tight budget or unexpected emergencies.

Additionally, HDHPs may not cover certain preventative care services that are covered under traditional health plans. This can result in missed opportunities for preventative care, which can lead to more significant health problems and higher costs down the road. It is essential to read the fine print and understand what is covered and what is not.

Another issue with HDHPs is they may not be the best option for pets who have pre-existing conditions or chronic illnesses. These types of pets require ongoing medical treatment, and the high deductible can make it difficult to manage the cost. Pets with pre-existing conditions may also be subject to exclusions, which means the insurance company will not pay for any treatments related to the pre-existing condition.

Lastly, HDHPs have a reputation for being difficult to understand and navigate. They may require more effort to keep track of the various out-of-pocket expenses, and the limitations and requirements of these plans can be hard to follow, which can create added stress for pet owners.

While high deductible health plans have some benefits, they are not always the best option for pet owners and their California Spangled cats. It is essential to consider the potential drawbacks and cons of these plans and compare them with traditional and wellness plans before making a decision.

Conclusion

After exploring the different healthcare plans available for your California Spangled, it’s clear that there is no one-size-fits-all solution. Each type of plan has its pros and cons, and it ultimately comes down to your individual needs and priorities.

Traditional/Standard Plans: If you prioritize predictable costs and don’t mind paying higher premiums, a traditional/standard plan may be the way to go. This type of plan provides comprehensive coverage and often includes preventative care.

High Deductible Health Plans: For those who prioritize lower monthly premiums and are willing to take on more out-of-pocket costs, a high deductible health plan may provide the coverage you need at a lower cost. Keep in mind that this type of plan often comes with a higher deductible and may not cover certain services until you’ve reached your deductible.

Wellness Plans: If your California Spangled is generally healthy and you’re looking for preventative care coverage, a wellness plan may be right for you. These plans often offer discounted preventative care services and provide incentives for healthy behaviors.

It’s important to carefully consider each plan’s pros and cons before choosing one for your California Spangled. While there are several options available, it’s ultimately up to you to decide which plan provides the best coverage for your pet’s unique needs.

No matter which plan you choose, make sure to schedule regular check-ups and preventative care visits for your California Spangled. This can help catch any potential health issues early on and ensure your furry friend stays healthy and happy for years to come.

Frequently Asked Questions

What is pet health insurance?

Pet health insurance provides coverage for veterinary bills such as preventative care, emergencies, and chronic illnesses.

How does pet health insurance work?

After enrolling your pet in a plan and paying the monthly premium, you visit a veterinarian of your choice and pay the bill upfront. Then, you submit a claim to the insurance company and receive a reimbursement for covered expenses.

What preventative care services are covered?

Preventative care services covered by most plans include annual exams, vaccinations, flea/tick prevention, heartworm prevention, and dental cleanings.

What emergency care services are covered?

Emergency care services covered by most plans include diagnostic tests, hospitalization, surgeries, and medications.

What chronic illnesses are covered?

Chronic illnesses covered by most plans include conditions such as diabetes, cancer, and arthritis.

What are the eligibility requirements for pet health insurance?

Most insurance companies require pets to be at least 8 weeks old and under 14 years old, with some exceptions for certain breeds and conditions.

What are the premium costs for pet health insurance?

Premium costs vary depending on the level of coverage and the age/breed of the pet, but can range from $20 to $100 per month.

Can you choose any veterinarian with pet health insurance?

Most plans allow you to choose any licensed veterinarian, but some have a network of preferred providers.

What is a deductible?

A deductible is the amount you pay out of pocket before the insurance coverage begins. For example, if your plan has a $500 deductible and your vet bill is $1,000, you would pay $500 and the insurance company would cover the remaining $500.

What is a co-pay?

A co-pay is a fixed amount you pay for a service, such as $25 for a veterinary exam. The insurance company covers the remaining cost of the service.